It’s impossible to conjure up a generic asset allocation strategy for someone without knowing their tolerance and capacity for risk, their short and long term goals, and the time they have to dedicate to managing their money. So I’m not going to try to do that. Instead, I’m going to describe my strategy of asset allocation and you decide if that might work for you.

My strategy is partly based on my fundamental investment philosophy that states, preservation of capital comes first, achieving maximum profits second. It’s also based on a variant of a strategy described in the book “The Black Swan: The Impact of the Highly Improbable.” It’s a New York Times best seller, written by Nassim Nicholas Taleb.

A Black Swan is a highly improbable event that has three characteristics: It is unpredictable, it has incredible impact, and after it happens we invent a reason for it that makes it seem less probable. The success of Apple, with the return of Steve Jobs was a black swan; as was 911. According to Taleb, black swans are endemic throughout our world.

A Black Swan is a highly improbable event that has three characteristics: It is unpredictable, it has incredible impact, and after it happens we invent a reason for it that makes it seem less probable. The success of Apple, with the return of Steve Jobs was a black swan; as was 911. According to Taleb, black swans are endemic throughout our world.

Taleb describes a strategy for investing that relies on this principle. And that’s to take 90% of your assets and put them in the most conservative investment vehicles possible (treasuries, bonds, etc.), then take the remaining 10% and invest small portions into a number of extremely risky stocks or ventures. And then let the black swan emerge. Of course there’s a chance you may never hit the jackpot, but you won’t lose anything either.

Well, that’s a bit extreme for me. While I want to maximize the potential to grow my assets, I need to balance that with protecting what I’ve managed to save for retirement. So, I’ve simply tweaked Taleb’s allocation between the conservative and risky investment piles, and taken a more traditional approach of diversification within each pile. My allocation percentage is 80% conservative, 20% speculative.

Yup, the old 80/20 rule. Also known as the Pareto principle, which states that for many events, 80% of the effects come from 20% of the causes. Just like in business, 80% of the sales persons comes from 20% of the clients. Well, in my portfolio, 80% of my growth will come from 20% of the assets.

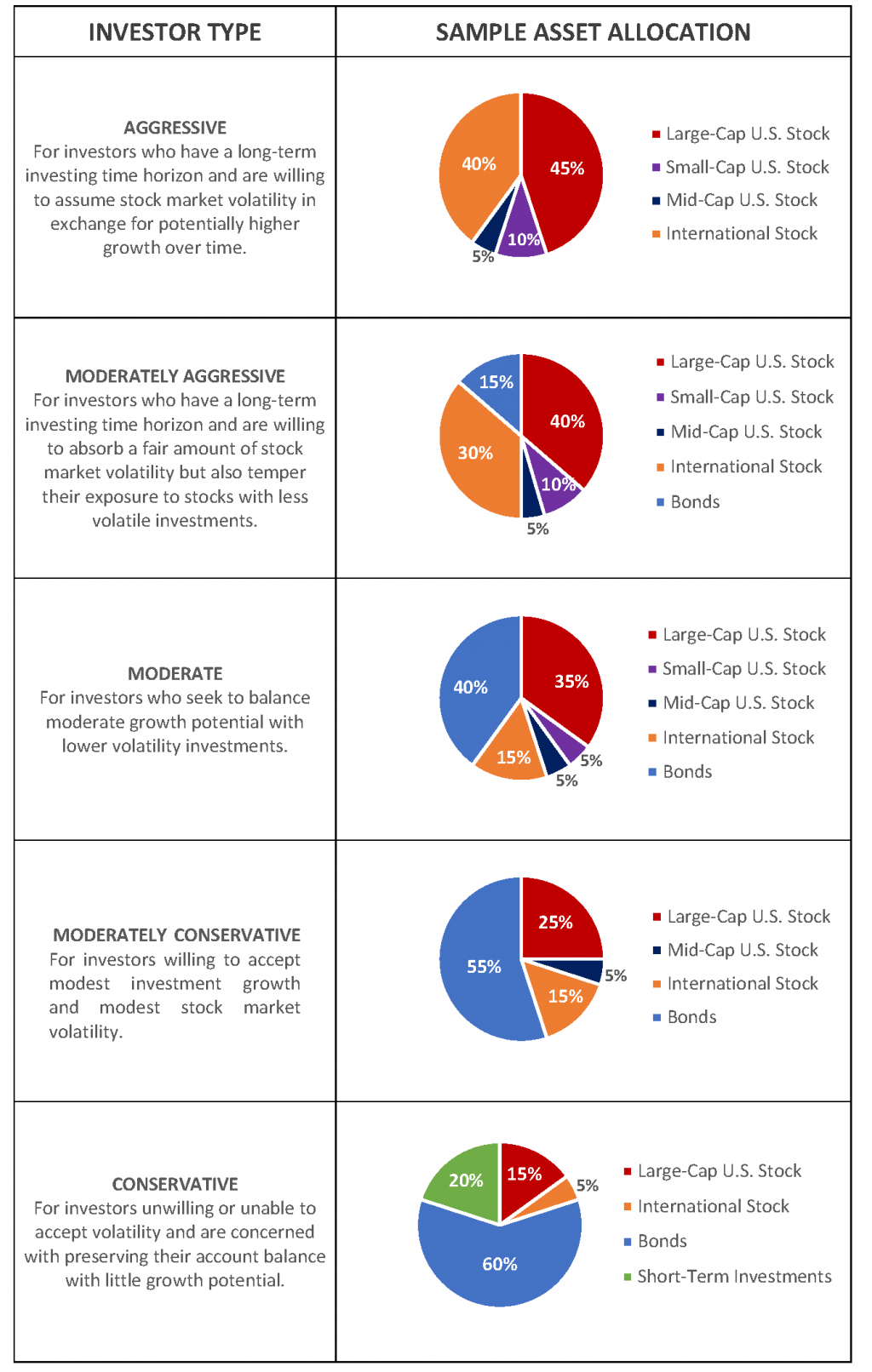

The conservative portion of my portfolio is invested in a mix of index funds, EFTs, treasuries, and real estate. The securities sit in a retirement account, for me that’s a SEP IRA. I’ve chosen the mix of funds based on my risk profile. The plan is that as I get closer to retirement, I’ll re-allocate the securities into more conservative choices. This generally means buying into a greater percentage of treasuries.

In my speculative portfolio I trade stocks through a brokerage account. I use margin to some degree, when the risk-reward ratio is favorable, but for the most part I limit positions to the available funds in the account. My goal is to diversify the investments in this account, but not to the detriment of making profit. My trading style is to take profits quickly, and when this account grows bigger than my 20% allotment, I move the excess into the IRA.

Now this brokerage account requires a significant amount of effort because I swing trade. So, the technical analysis required to manage the trades and mine opportunities can be significant. But I do it because I’m good at it and it’s fun. Besides, it provides me with an endless number of subjects to write about in this blog.

![]()

Email Alert Service

If you want to learn more about Technical Analysis and get daily updates of the markets, then sign up for the Apple Investor Alert Service. It’s completely free! You’ll receive HTML formatted alerts with analysis, tips, and education guides. You could easily pay $100 per month for similar services, but you get it free by signing up.

For more information, please contact Ernie at ernie@apple-investor.com